IEA’s World Energy Investment Report, 2021

Context:

The International Energy Agency (IEA) published the World Energy Investment Report, 2021 which said that most of the Global energy investment is expected to shift out of traditional fossil fuel production.

Relevance:

GS-III: Industry and Infrastructure (Energy Sector, Sources of Energy, Types of Resources and Sustainable use of Resources), GS-III: Environment and Ecology (Conservation of Environment, Important International Institutions)

Dimensions of the Article:

- About the International Energy Agency (IEA)

- Highlights of the World Energy Investment Report, 2021

About the International Energy Agency (IEA)

- The International Energy Agency (IEA) is an autonomous Intergovernmental Organisation established in 1974 in Paris, France.

- IEA mainly focuses on its energy policies which include economic development, energy security and environmental protection. These policies are also known as the 3 E’s of IEA.

- It is best known for the publication of its annual World Energy Outlook.

IEA’s Role and Functions:

- IEA’s role has expanded to cover the entire global energy system, encompassing traditional energy sources such as oil, gas, and coal as well as cleaner and faster growing ones such as solar PV, wind power and biofuels.

- IEA acts as a policy adviser to its member states, as well as major emerging economies such as Brazil, China, India, Indonesia and South Africa to support energy security and advance the clean energy transition worldwide.

- IEA’s mandate has broadened to focus on providing analysis, data, policy recommendations and solutions to help countries ensure secure, affordable and sustainable energy for all. In particular, it has focused on supporting global efforts to accelerate the clean energy transition and mitigate climate change.

- The IEA has a broad role in promoting rational energy policies and multinational energy technology co-operation with a view to reaching net zero emissions.

- IEA Clean Coal Centre is dedicated to providing independent information and analysis on how coal can become a cleaner source of energy, compatible with the UN Sustainable Development Goals.

Membership of IEA

- The IEA is made up of 30 member countries. Only OECD member states can become members of the IEA.

- IEA member countries are required to maintain total oil stock levels equivalent to at least 90 days of the previous year’s net imports.

- In 2018, Mexico joined the IEA and became its 30th member.

- India became an Associate member of IEA (NOT full membership) in 2017 but it was in engagement with IEA long before its association with the organization.

- Other Association Countries of IEA apart from India are: Brazil, China, Indonesia, Morocco, Singapore, South Africa and Thailand.

Highlights of the World Energy Investment Report, 2021

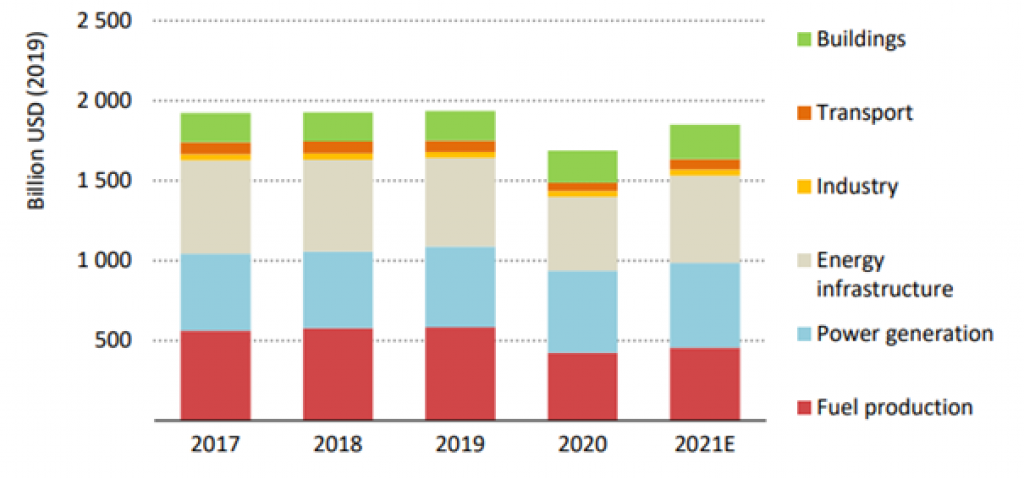

- Global energy investment is expected to rebound in 2021 and increase 10% year-on-year to around USD 1.9 trillion and most of this investment will flow towards power and end-use sectors, shifting out of traditional fossil fuel production.

- Renewable power will have the largest share with around 70% of the total investment in energy spent on new power generation capacity.

- Upstream (production and exploration) investment in oil is expected to grow 10%. This expansion in fossil fuels was planned with novel technologies like Carbon Capture and Storage (CCS) and bioenergy CCS, which are yet to attain commercial success.

- The increment of coal-fired power in 2020, mostly driven by China, is indicating that coal is down but not yet out.

- The above positive scenarios will still not deter the increase in carbon dioxide emission, after contraction in 2020 mainly due to economic slowdown induced by the novel coronavirus pandemic.

- Many developing nations’ supporting policy and regulatory frameworks are not yet aligned with long-term net-zero goals.

- In many Emerging Market and Developing Economies (EMDEs), investment in renewables was hit harder by Covid-19 than in developed nations – and now many EMDEs have prioritised coal and oil in recovery plans.

Recently in News: IEA’s Net Zero Emissions (NZE) Roadmap

Why is there an increase in emissions?

- The emerging market is almost 70% responsible for demand growth and hence the increased emissions; India plays an important part in this block.

- China is showing a tremendous expansion in coal-based power production — their coal consumption in December 2020 was a historic high — though the country has a commendable renewable growth.

- Although the US has shown renewed commitment to the multilateral United Nations system for tackling climate change by re-joining the Paris agreement. Its fascination with cheap shale gas is creating an investment distortion and adversely affecting the sustainability of developmental pathways of countries like India.

Srivilliputhur-Megamalai Tiger Reserve & Vaigai

Context:

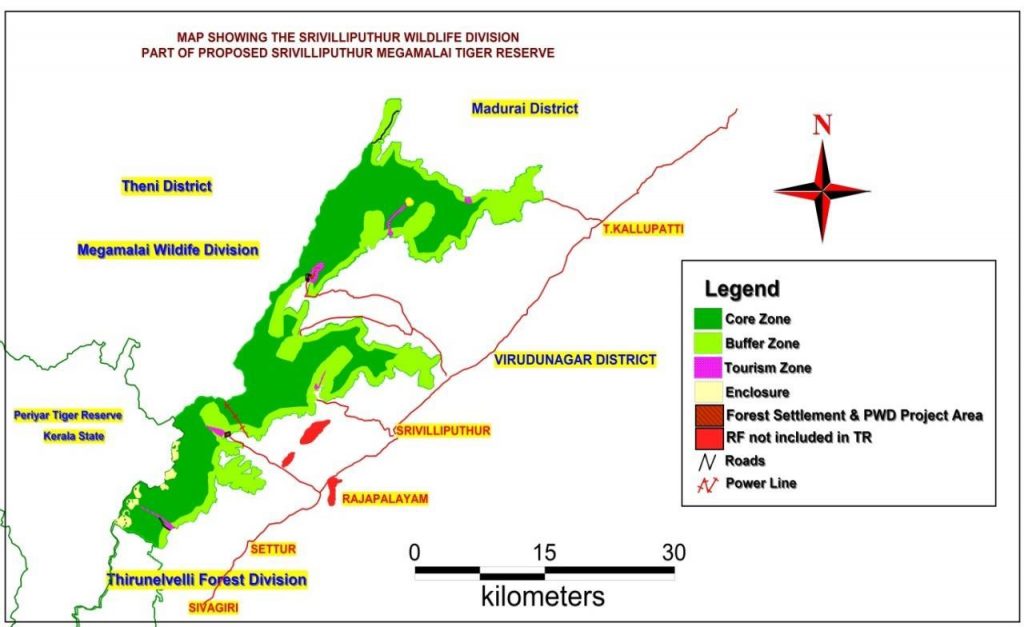

In a government order, State Forests Secretary had declared the creation of Srivilliputhur Megamalai Tiger Reserve in February 2021.

The Srivilliputhur-Megamalai Tiger Reserve will provide protection to Megamalai, the Vaigai’s primary catchment, in turn helping water levels to rise in the river.

Relevance:

GS-III: Environment and Ecology (Important Protected Areas, Conservation of Biodiversity), GS-I: Geography (Water Resources, Drainage system of India)

Dimensions of the Article:

- Vaigai River

- Srivilliputhur-Megamalai Tiger Reserve

- About Grizzled Squirrel Wildlife Sanctuary

Vaigai River

- The Vaigai is a river in the Tamil Nadu state of southern India; it passes through the towns of Theni, Dindigul and Madurai.

- It originates in Varusanadu Hills, the Periyar Plateau of the Western Ghats range, and flows northeast through the Kambam Valley, which lies between the Palani Hills to the north and the Varushanad Hills to the south.

- As it rounds the eastern corner of the Varushanad Hills, the river turns southeast, running through the region of Pandya Nadu. Madurai, the largest city in the Pandya Nadu region and its ancient capital, lies on the Vaigai.

- The river empties into the Palk Strait near Uchipuli, close to Pamban bridge in Ramanathapuram District.

- The main tributaries of the river Vaigai are, the river Suruliyaru, the river Mullaiyaaru, the river Varaganadi, the river Manjalaru, river kottagudi and river Kridhumaal, Upparu river.

- Vaigai Dam is the major dam in this river which is present in Theni District

- Vaigai gets major feed from the Periyar Dam in Kumili, Kerala. Water from the Periyar River in Kerala is diverted into the Vaigai River in Tamil Nadu via a tunnel through the Western Ghats.

- In summers, the Vaigai river ends up dry very often. The water never reaches Madurai, let alone flowing into places past Madurai.

Srivilliputhur-Megamalai Tiger Reserve

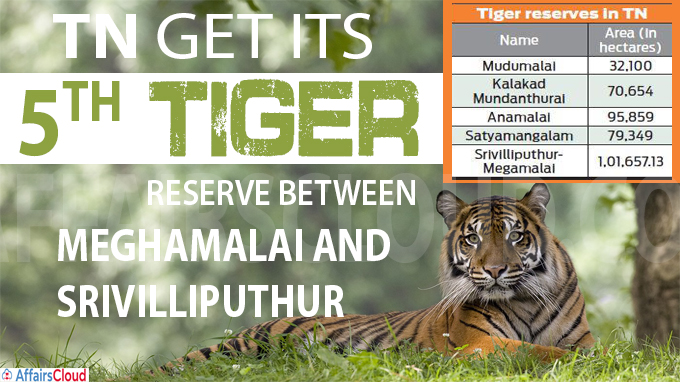

- Srivilliputhur Megamalai Tiger Reserve is the fifth tiger reserve in Tamil Nadu, created in 2021.

- An area of more than 1 lakh hectares in Srivilliputhur Grizzled Giant Squirrel Sanctuary and Megamalai Wildlife Sanctuary have been combined to create the tiger reserve.

Benefits of the creation of the new tiger reserve:

- Tigers from the neighboring Periyar Tiger Reserve and the Anamalai Tiger Reserve regions can find significant habitats and breeding and home ranges in the highly undulating terrains of Srivilliputhur and Megamalai hilly tracts.

- The forested habitats of the Srivilliputhur regions, which are largely uninhabited and undisturbed, could provide excellent buffering grounds to the tigers of Periyar Tiger Reserve as much as they can offer excellent genetic exchange grounds for the tigers of Anamalai region.

- According to the concept note, tiger disperses in large areas and such dispersals are important for the exchange of genes. This process is essential for long term growth of a population.

- With this new tiger reserve, Vaigai river and its catchment areas will be fully protected. Vaigai’s tributaries will start flowing again and

About Grizzled Squirrel Wildlife Sanctuary

- The Grizzled Squirrel Wildlife Sanctuary (GSWS), also known as Srivilliputhur Wildlife Sanctuary, was established in 1988 to protect the Near threatened grizzled giant squirrel (Ratufa macroura).

- It is bordered on the southwest by the Periyar Tiger Reserve and is one of the best-preserved forests south of the Palghat Gap. It consists of high hills and valleys, with a number of peaks reaching up to 1,800 metres (5,900 ft).

- In addition to grizzled giant squirrels, other animals seen here are Bengal tiger, bonnet macaque, common langur, elephants, flying squirrels, gaur, Indian giant squirrel, leopard, lion-tailed macaques, mouse deer, Nilgiri langur, Nilgiri Tahrs, palm civets, porcupine, sambar, slender loris, sloth bear, spotted deer, tree shrews, wild boar and wild cats.

- Recognised as an Important Bird Area, over 275 species of birds are seen in this sanctuary including 14 species of birds endemic to the Western Ghats, such as the critically endangered Oriental white-backed vulture and the long-billed vulture, vulnerable species Nilgiri wood-pigeon, broad-tailed grass warbler, red-faced malkoha and the white-bellied shortwing (Brachypteryx major) and near threatened species like the great pied hornbill, Nilgiri pipit, black-and-orange flycatcher and the Nilgiri flycatcher.

- The conservation problems affecting the sanctuary are human-elephant conflict, human encroachment, cattle grazing and forest fire.

Banks to shift Rs. 89,000 crore NPAs to NARCL

Context:

Banks have identified about 22 bad loans worth ₹89,000 crore to be transferred to the National Asset Reconstruction Company Ltd. (NARCL) in the initial phase.

Relevance:

GS-III: Indian Economy (Growth and Development of Indian Economy, NPAs)

Dimensions of the Article:

- What is an Asset Reconstruction Company?

- What are Bad Banks?

- National Asset Reconstruction Company Ltd (NARCL)

- Highlights RBI’s report on Growth of the ARC Industry

- Issues with Indian ARCs

What is an Asset Reconstruction Company?

- An asset reconstruction company is a special type of financial institution that buys the debtors of the bank at a mutually agreed value and attempts to recover the debts or associated securities by itself.

- The asset reconstruction companies or ARCs are registered under the RBI. Hence, RBI has the power to regulate the ARCs.

- ARCs are regulated under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act, 2002).

- The ARCs take over a portion of the debts of the bank that qualify to be recognised as Non-Performing Assets. Thus, ARCs are engaged in the business of asset reconstruction or securitization (securitization is the acquisition of financial assets either by way of issuing security receipts to Qualified Buyers or any other means) or both.

- All the rights that were held by the lender (the bank) in respect of the debt would be transferred to the ARC. The required funds to purchase such such debts can be raised from Qualified Buyers.

- The ARC can take over only secured debts which have been classified as a non-performing asset (NPA). In case debentures / bonds remain unpaid, the beneficiary of the securities is required to give a notice of 90 days before it qualifies to be taken over.

What are Bad Banks?

- A Bad Bank (usually set up as a government-backed bad bank) is technically an asset reconstruction company (ARC) or an asset management company.

- Bad banks are typically set up in times of crisis when long-standing financial institutions are trying to recuperate their reputations and wallets.

How does it work?

- A bad bank buys the bad loans and other illiquid holdings of other banks and financial institutions, which clears their balance sheet.

- A bad bank structure may also assume the risky assets of a group of financial institutions, instead of a single bank.

- The bad bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans.

National Asset Reconstruction Company Ltd (NARCL)

- National Asset Reconstruction Company Ltd (NARCL) is the name coined for the bad bank announced in the Budget 2021-22.

- The new entity is being created in collaboration with both public and private sector banks.

- NARCL will take over identified bad loans of lenders and the lead bank with offer in hand of NARCL will go for a ‘Swiss Challenge’, where other asset reconstruction players will be invited to better the offer made by a chosen bidder for finding higher valuation of an NPA on sale. The company will pick up those assets that are 100 per cent provided for by the lenders.

- The biggest advantage of NARCL would be aggregation of identified NPAs (non-performing assets). This is expected to be more efficient in recovery as it will step into the shoes of multiple lenders who currently have different compulsions when it comes to resolving a bad loan.

- After enactment of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act in 2002, regulatory guidelines for ARCs were issued in 2003 to enable development of this sector and to facilitate smooth functioning of companies such as NARCL.

Highlights RBI’s report on Growth of the ARC Industry

- The ARC industry began with the establishment of the Asset Reconstruction Company India Ltd (ARCIL) in 2003.

- After remaining subdued in the initial years of their inception, a jump was seen in the number of ARCs in 2008, and then in 2016.

- There has been a concentration in the industry in terms of Assets Under Management (AUM) and the Security Receipts (SRs) issued.

- The growth in ARCs’ AUM has been largely trendless except for a major spurt in FY14.

- The AUM of ARCs has been on a declining trend when compared with the volume of NPAs of banks and NBFCs, except during the period of high growth in the AUM around 2013-14.

- During 2019-20, asset sales by banks to ARCs declined, which could probably be due to banks opting for other resolution channels such as Insolvency and Bankruptcy Code (IBC) and SARFAESI.

Issues with Indian ARCs

- Indian ARCs have been private sector entities registered with the Reserve Bank. Public sector AMCs in other countries have often enjoyed easy access to government funding or government-backed. The capital constraints have often been highlighted as an area of concern for ARCs in India.

- Despite the regulatory push to broaden, and thereby enhance, the capital base of these companies, they have remained reliant primarily on domestic sources of capital, particularly banks.

- Banks supply NPAs to the ARCs, hold shareholding in these entities and also lend to them, which makes it necessary to monitor if there is a “circuitous movement of funds between banks and these institutions”.

China hosts ASEAN ministers, with message for Quad

Context:

China is hosting foreign ministers from the 10 ASEAN countries with Beijing pushing for closer economic cooperation and aligning COVID-19 recovery efforts even as it looks to push back against the recent regional outreach of the Quad grouping.

Relevance:

GS-II: International Relations (Important International Groupings, Foreign Policies affecting India’s Interests)

Dimensions of the Article:

- The Association of Southeast Asian Nations (ASEAN)

- About the ASEAN ministers meeting hosted by China

- What is the Quad grouping?

The Association of Southeast Asian Nations (ASEAN)

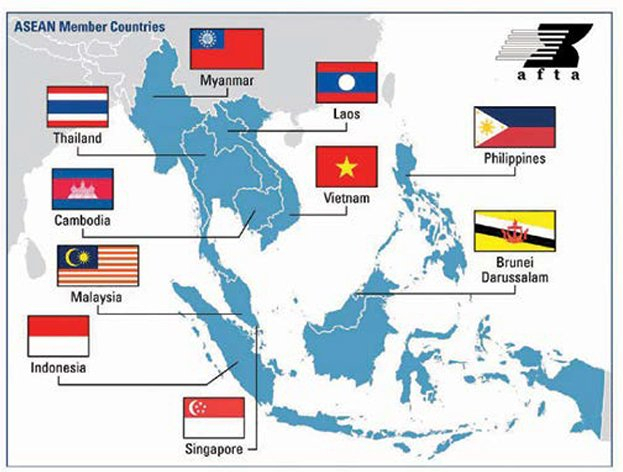

- The Association of Southeast Asian Nations (ASEAN) is a regional intergovernmental organization comprising Ten Countries in Southeast Asia.

- In 1967 ASEAN was established with the signing of the ASEAN Declaration (Bangkok Declaration) by its founding fathers: Indonesia, Malaysia, Philippines, Singapore and Thailand.

- ASEAN is headquartered in Jakarta, Indonesia.

- The motto of ASEAN is “One Vision, One Identity, One Community”.

- 8th August is observed as ASEAN Day.

- Chairmanship of ASEAN rotates annually, based on the alphabetical order of the English names of Member States.

- ASEAN is the 3rd largest market in the world – larger than EU and North American markets.

- A major partner of Shanghai Cooperation Organisation, ASEAN maintains a global network of alliances and dialogue partners and is considered by many as the central union for cooperation in Asia-Pacific.

- Members of ASEAN

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Brunei

- Vietnam

- Laos

- Myanmar

- Cambodia

About the ASEAN ministers meeting hosted by China

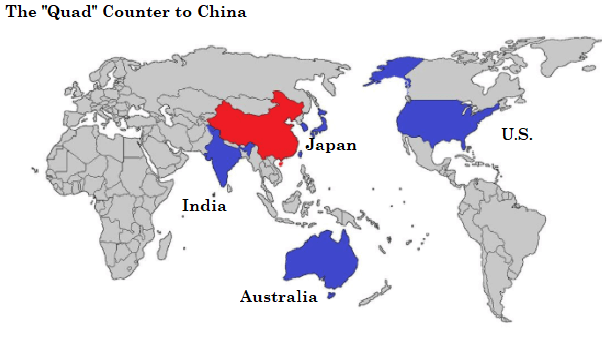

- Chinese officials have in recent weeks stepped up criticism of the Quad — the informal India, Australia, Japan and United States grouping — and of Washington in particular.

- During recent visits to Sri Lanka and Bangladesh, China’s Defence Minister called on both countries to reject “military alliances” — a term that some Beijing are using to describe the Quad, but a label that the group rejects.

- China’s Foreign Ministry spokesperson said that a vaccine passport connecting China and ASEAN countries is also being discussed.

- According to China deepening economic cooperation, particularly following the signing of the Regional Comprehensive Economic Partnership (RCEP) trade deal, would be China’s focus.

What is the Quad grouping?

- The Quadrilateral Security Dialogue (QSD) also known as Quad, is an Inter-governmental security forum. It comprises of 4 countries– India, the United States, Japan and Australia. The member countries of the Quad organise summits, exchanges the information and military drills.

- In the year 2007, Prime Minister of Japan Shinzo Abe proposed the Quadrilateral Security Dialogue. The forum was joined by the Vice President of the US Dick Cheney, Prime Minister John Howard of Australia and Indian Prime Minister Manmohan Singh. It was paralleled by joint military exercises of an unprecedented scale with the name Exercise Malabar.

- India’s past experiment: Over the years, India has experimented with alliances of different kinds:

- During World War I, some nationalists aligned with imperial Germany to set up the first Indian government-in-exile in Kabul.

- During World War II, Subhas Chandra Bose joined forces with imperial Japan to set up a provisional government in Port Blair.

- Jawaharlal Nehru, who unveiled and championed non-alignment, signed security treaties with Bhutan, Nepal, and Sikkim. Also, Nehru, who actively opposed American alliances in Asia, turned to the US for military support in 1962.