Rajya Sabha MPs suspended for entire session

Context:

In a move that angered the Opposition and set the stage for acrimonious exchanges, a dozen members of Opposition parties in Rajya Sabha were suspended from the winter session on the very first day following a motion brought in by the government.

Relevance:

GS-II: Polity and Constitution (Constitutional Provisions, Legislature)

Dimensions of the Article:

- Why were the MPs suspended?

- Provisions in House Rules of Rajya Sabha for punishing members

- Issue in the present context

Why were the MPs suspended?

- The members were suspended for alleged unruly conduct towards the end of the monsoon session in August 2021 when marshals were called after Opposition members stormed the Well of the House during the passage of the General Insurance Business (Nationalisation) Amendment Bill, 2021.

- The motion for suspension was moved by Parliamentary Affairs Minister Pralhad Joshi, was passed by voice vote even as the Opposition protested.

- The rule has been used 13 times in the past to suspend MPs since 1962.

Provisions in House Rules of Rajya Sabha for punishing members

For conduct inside the House

- Rule 256 of the Rajya Sabha’s Rules of Procedure specifies the acts of misconduct: Disregarding the authority of the chair, abusing the rules of the council by persistently and willfully obstructing the business thereof.

- However, the power to suspend a member is vested in the House, not in the chairman.

- Under the rule, the maximum period of suspension is for the remainder of the session.

- By convention, a suspended member loses his right to get replies to his questions.

- Thus, suspension from the service of the House is regarded as a serious punishment.

- But, surprisingly, the rules do not spell out the disabilities of a suspended member.

- These are imposed on them as per conventions or precedent.

- Suspension for the remainder of the session makes sense only when they are suspended immediately after the misconduct has been noticed by the chair.

- The rules of the House do not empower Parliament to inflict any punishment on its members other than suspension for creating disorder in the House.

Misconduct outside the House

- For the acts of misconduct by the MPs outside the House, which constitute a breach of privilege or contempt of the House, usually the privilege committee investigates the matter and recommends the course of action and the House acts on it.

- A special committee is appointed usually when the misconduct is so serious that the House may consider expelling the member.

- Special committee was appointed in 2005 to inquire into the issue of MPs accepting money for raising questions in Parliament.

- So, special ad-hoc committees are appointed only to investigate serious misconduct by MPs outside the House.

Issue in the present context

- It appears that the Rajya Sabha secretariat has prepared a report on the incident in the Rajya Sabhi, which accuses some MPs of assaulting security personnel.

- But special ad-hoc committees are appointed only to investigate serious misconduct by MPs outside the House.

- No special committee is required to go into what happens before the eyes of the presiding officer inside the House.

- As per the rules of the House, they need to be dealt with then and there.

- The rules do not recognise any punishment other than suspension for a specific period and in this case, the Session is already over.

- Article 20 of the Constitution prohibits a greater penalty than what the law provided at the time of committing the offence.

-Source: The Hindu

Omicron variant poses very high global risk: WHO

Context:

In light of the increasing case numbers of the Omicron coronavirus variant, the World Health Organization (WHO) has come out with its advisory on the new variant.

Omicron was first reported from South Africa and has since spread to more than a dozen countries. A few countries have begun imposing travel restrictions in a bid to counter the threat of spread of the new variant.

Relevance:

GS-III: Science and Technology

Dimensions of the Article:

- Significance of the Omicron variant of the coronavirus

- Why is it named Omicron?

- What do spike mutations do?

- About the WHO advisory on Omicron variant

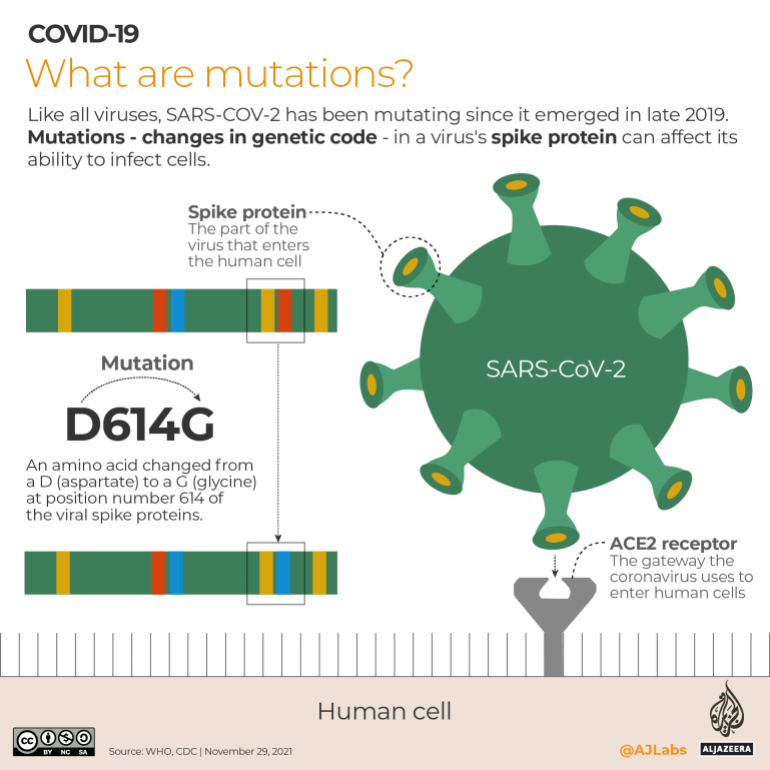

Significance of the Omicron variant of the coronavirus

- The Omicron variant is interesting due to the fact that it has a large number of mutations compared to other prevalent variants circulating across the world.

- This includes 32 mutations in the spike protein.

- Many of these mutations lie in the receptor-binding domain of the spike protein, a key part of the protein required for binding to the human receptor proteins for entry into the cell.

- It can thus play an important role in recognition by antibodies generated due to a previous infection or by vaccines.

Why is it named Omicron?

- The WHO has been using Greek letters to refer to the most widely prevalent coronavirus variants, which otherwise carry long scientific names.

- It had already used 12 letters of the Greek alphabet before the newest variant emerged in South Africa this week.

- After Mu, the 12th named after a Greek letter, WHO selected the name Omicron, instead of Nu or Xi, the two letters between Mu and Omicron.

- The WHO said Nu could have been confused with the word ‘new’ while Xi was not picked up following a convention.

What do spike mutations do?

- Many of the mutations in the spike protein have been previously suggested to cause resistance to antibodies as well as increased transmission.

- Thus, there is a possibility that this variant could be more likely to re-infect people who have developed immunity against previous variants of the virus.

- The behavior of the virus is not yet accurately predictable based on the evidence on individual mutations.

About the WHO advisory on Omicron variant

- The World Health Organization (WHO) has warned that the heavily mutated Omicron coronavirus variant is likely to spread internationally and poses a very high risk of infection surges.

- The impact is likely to be more severe on vulnerable populations, particularly in countries with low vaccination coverage.

- WHO has urged all the nations to accelerate vaccination of high-priority groups and device plans to tackle any surge in infections from the new variant.

-Source: The Hindu

RBI puts entry of big businesses in banking on hold

Context:

The Reserve Bank of India (RBI) has kept in limbo the proposal of its Internal Working Group (IWG) for granting banking licence to big corporate houses amid fears over connected lending and self-dealing if they are allowed in the banking space.

Relevance:

GS-III: Indian Economy

Dimensions of the Article:

- RBI on entry of big businesses in banking

- Advantages of allowing Corporations to own bank

- Disadvantages of allowing Corporation to own bank

- Way Forward

RBI on entry of big businesses in banking

- Corporate Houses (CH) were active in the banking sector till five decades ago when the banks promoted by them were nationalised in the late sixties amid allegations of connected lending and misuse of depositors’ money.

- The Banking sector was opened up again for the CHs Post Liberalisation (1991) with the first round of licensing of private banks that was done in 1993.

- Since then, there were two more rounds of licensing of banks in the private sector – in 2003-04 and 2013-14 – culminating with the on-tap licensing regime of universal banks in 2016. However, even some prominent business houses were not considered in 2013-14.

Advantages of allowing Corporations to own bank

- Currently, the government keeps picking money from the taxpayers pocket and funding the public sector banks. Hence, by allowing the big corporates into the banking sector the capital requirement can be fulfilled.

- Even today a significant population do not have access to banking in the country, the corporates’ entry would mean the opening of more branches and subsequently bringing more people into the banking net.

- Privatization of banks has been a long-proposed reform in the Indian banking industry. Allowing corporations into the banking sector will further pressurize Public sector banks to become competitive.

Disadvantages of allowing Corporation to own bank

- There are apprehensions that it would not be easy for supervisors to prevent or detect self-dealing or connected lending as banks could hide connected party or related party lending behind complex company structures and subsidiaries or through lending to suppliers of promoters and their group companies. Connected lending involves the controlling owner of a bank giving loans to himself or his related parties and group companies at favourable terms and conditions.

- Big business groups already account for a major chunk of Non-Performing Assets (NPAs) in the banking system even without becoming promoters of a bank. In ethical terms, this will erode the bank’s role as an effective financial and create a moral hazard or conflict of interest situation.

- Under circular lending, corporate bank X funding projects of an industry group, which owns corporate bank Y, and corporate bank Y funding projects of an industry group owning bank Z, and finally, corporate bank Z funding projects of industry group owning bank X. With available legal structures and the proliferation of shell companies, makes it hard to track such lending on a real-time basis.

- Corporations owning banks will add more muscle to big industry groups, which already dominate many important sectors of the economy, including telecom, organised retail, aviation, software and e-commerce. This will further accelerate the concentration of wealth and increase inequalities.

- The banking sector in India has been in trouble for the last few years, keeping that in mind the RBI in 2016 had created new guidelines on the limit of lending to a single company. The rationale behind this ruling was that if a bank lends too much to one company only then it risks losing that money if the company sinks. Therefore, the recommendation of allowing the entry of industry groups in the banking sector is in contradiction with the above-said ruling in 2016.

Way Forward

- Before granting much economic power in the hands of corporations, it is imperative to carry out the long-pending banking reforms and strengthen the functional autonomy of RBI.

- The recent failures on internal and external controls like in the case of PNB leading to an alarming fraud, where all stakeholders lost money and credibility have given rise to the need of new regulations with a very high degree of supervisory mechanism and corporate governance which has strong Information Technology (IT) and Artificial Intelligence (AI) enabled platform.

- Where a corporate house is a promoter, strict regulations on the use of funds held with the bank and monitoring of related party transactions will be essential.

- Fit and proper criterion needs to be foolproof and the common citizens should become the beneficiaries in the process.

-Source: The Hindu

Cross border insolvency: UN model UNCITRAL

Context:

The Ministry of Corporate Affairs (MCA) has published a draft framework for cross border insolvency proceedings based on the UNCITRAL (United Nations Commission on International Trade Law) model under the Insolvency and Bankruptcy Code.

Relevance:

GS-II: International Relations

Dimensions of the Article:

- What are Cross border insolvency proceedings?

- About UNCITRAL

- The UNCITRAL model

- Indian framework’s difference with the model law

What are Cross border insolvency proceedings?

- Cross border insolvency proceedings are relevant for the resolution of distressed companies with assets and liabilities across multiple jurisdictions.

- A framework for cross border insolvency proceedings allows for the location of such a company’s foreign assets, the identification of creditors and their claims and establishing payment towards claims as well as a process for coordination between courts in different countries.

Current status of foreign stakeholders in other jurisdictions under IBC

- While foreign creditors can make claims against a domestic company, the IBC currently does not allow for automatic recognition of any insolvency proceedings in other countries.

- In the case of Jet Airways, when one of the company’s aircraft was grounded in Amsterdam over non-payment of dues to a European cargo firm, the National Company Law Tribunal had declined to “take on record” any orders of a foreign court regarding domestic insolvency proceedings in the absence of enabling provision in the IBC.

- The National Company Law Appellate Tribunal, however, permitted the recognition of Dutch proceedings as “non-main insolvency proceedings” recognising India as the Centre Of Main Interests (COMI) for the company.

- However, current provisions under the IBC do not allow Indian courts to address the issue of foreign assets of a company being subjected to parallel insolvency proceedings in other jurisdictions.

About UNCITRAL

- The United Nations Commission on International Trade Law (UNCITRAL) is a subsidiary body of the U.N. General Assembly (UNGA) responsible for helping to facilitate international trade and investment.

- Established by the UNGA in 1966, UNCITRAL’s official mandate is “to promote the progressive harmonization and unification of international trade law” through conventions, model laws, and other instruments that address key areas of commerce, from dispute resolution to the procurement and sale of goods.

- UNCITRAL carries out its work at annual sessions held alternately in New York City and Vienna, where it is headquartered.

The UNCITRAL model

- The UNCITRAL model is the most widely accepted legal framework to deal with cross-border insolvency issues. It has been adopted by 49 countries, including the UK, the US, South Africa, South Korea and Singapore.

- The law allows automatic recognition of foreign proceedings and rulings given by courts in cases where the foreign jurisdiction is adjudged as the COMI for the distressed company. Recognition of foreign proceedings and reliefs is left to the discretion of domestic courts when foreign proceedings are non-main proceedings.

- The COMI for a company is determined based on where the company conducts its business on a regular basis and the location of its registered office.

- The framework for cross border insolvency adopted in India may like in the case of some other countries require reciprocity from any country which seeks to have its insolvency proceedings recognised by Indian courts. This would allow Indian proceedings for foreign corporate debtors to be recognised in foreign jurisdictions.

Indian framework’s difference with the model law

- Many countries that adopt the UNCITRAL model law do make certain changes to suit their domestic requirements.

- A report by the MCA has recommended that the Indian cross border insolvency framework exclude financial service providers from being subjected to cross border insolvency proceedings, noting that many countries “exempt businesses providing critical financial services, such as banks and insurance companies, from the provisions of cross- border insolvency frameworks.”

- The report has also recommended that companies undergoing the Pre-packaged Insolvency Resolution Process be exempted from cross border insolvency proceedings as the provisions for PIRP have been introduced recently, and the “jurisprudence and practice under the pre-pack mechanism are at a nascent stage”.

SOURCE:https://www.thehindu.com/

READ OTHER ARTICLES HERE:https://www.pmias.in/current-events/