Key Takeaways From Interim Budget (2024-25)

Syllabus: GS3/Indian Economy

Context:

- Recently, the Union Finance Minister presented the Union Budget for the next financial year (2024-25) in the Parliament.

Key Takeaways in the Budget

Capital Expenditure (2024-25):

- It was raised to ₹11.1 lakh crore for FY25 from the ₹9.5 lakh crore in the previous fiscal.

- This would be 3.4% of the GDP.

- The proportion of capital expenditure (excluding grant in aid) to total expenditure stands at 23.31%.

- In 2024-25, the total expenditure is estimated at ₹47.66 lakh crore, a 6.1% increase over the revised estimates of 2023-24.

Fiscal Prudence:

- The budget estimates for the fiscal deficit for FY 25 was pegged at 5.1%, down from the revised estimates of 5.8% last fiscal year.

Achievement of Taxation Reform:

- Direct Taxes:

- Direct tax collections have more than tripled in the last ten years, with return filers increasing by 2.4 times.

- Reduction and rationalisation of tax rates implemented:

- No tax liability for income up to Rs 7 lakh under the new tax scheme, increased from Rs 2.2 lakh in FY 2013-14.

- Introduction of Faceless Assessment and Appeal for greater efficiency and transparency.

- Indirect Taxes:

- GST unified the indirect tax regime, reducing compliance burdens.

- GST transition viewed positively by 94% of industry leaders; 80% reported supply chain optimization.

- GST tax base more than doubled; average monthly gross GST collection nearly doubled to Rs 1.66 lakh crore.

- States benefited from SGST revenue, showing a higher tax buoyancy post-GST.

- Customs: Import release time significantly reduced at Inland Container Depots, air cargo complexes, and sea ports.

- GST unified the indirect tax regime, reducing compliance burdens.

State-wise Allocation of Central Taxes and Duties:

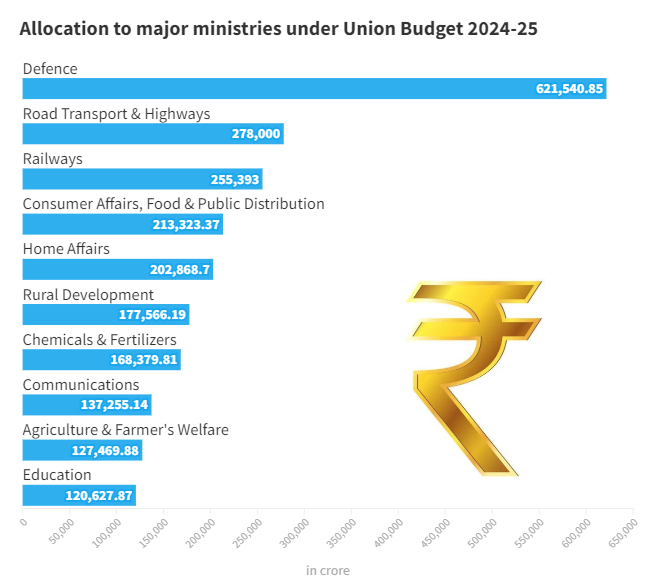

Allocation to Ministries:

- The Union Budget allocated a massive ₹6.21 lakh crore for the Defence Ministry, followed by Road Transport & Highways with ₹2.78 lakh crore and Railways with ₹2.55 lakh crore.

For Example:

- Education budget for 2024-25 seen at Rs 1.25 lakh crore, 14.5% higher than revised estimate of Rs 1.1 lakh crore for 2023-24.

- Housing: New housing plan for the middle class; 2 crore houses to be built under PM Aavas Yojana; Pradhan Mantri Awas Yojana (Grameen) close to achieving target of 3 crore houses, additional 2 crore targeted for next 5 years.

- Agriculture: Investment in post-harvest activity by both private and public sector support; Empowering dairy farmers; More efforts to control Foot and mouth disease; Application of Nano-DAP to be expanded in all agro-climatic zones; Crop insurance has been given to 4 crore farmers under PM Fasal Bima Yojana; Five integrated Aqua Park to be set up; Blue Economy 2.0 to promote aquaculture; Implementation of Pradhan Mantri Matsaya Sampada Yojana; and Direct financial assistance to 11.8 crore farmers under PM-KISAN.

- Renewable energy: Viability gap funding for wind energy; Setting up of coal gasification and liquefaction capacity; Phased mandatory blending of CNG, PNG and compressed biogas; Financial assistance for procurement of biomass aggregation machinery; 1 crore households will be enabled to obtain up to 300 units of free electricity per month.

Health Expenditure:

- The expenditure for the Department of Health & Family Welfare for FY25 is Rs. 10,000 crores more than the revised estimates of the current FY.

- But the allocation to the Union Ministry of Health is estimated to be 1.9% of the total expenditure, continuing the trend of staying below the 2% mark from 2022-23.

- Healthcare facilities under Ayushman Bharat will be extended to all Asha workers, Aanganwadi workers.

- Vaccination of 9-14 year old girls for cervical cancer

- Saksham Anganwadi and Poshan 2.0 to be expedited for improved nutrition delivery, early childhood care and development

Railway Budget in a Glance:

- Railway projects have been identified under the PM Gati Shakti Yojana for enabling multi-modal connectivity.

- It aims to ‘improve logistics efficiency and reduce costs’.

- Railway Infrastructure: To expand India’s railway infrastructure, three major railway economic corridors were announced.

- These include an energy, mineral and cement corridor, a port connectivity corridor and a high traffic density corridor.

- It emphasised that these corridors, along with dedicated freight corridors, aim to accelerate the country’s GDP and reduce logistic costs.

- Additionally, there will be 40,000 normal train bogies to be converted into high-speed Vande Bharat ones.

Conclusion:

- The Interim Budget is a temporary budget that is presented by the government in an election year. It ranged from railways, tourism, healthcare, technology, aviation, green energy, aquaculture, housing, etc.

- However, the new government will present its full budget after the newly elected Lok Sabha, outlining the government’s financial roadmap for the entire fiscal year.

Concerns in the Interim Budget (2024-25)

Syllabus: GS3/Indian Economy

Context:

- There are concerns over GDP, expenditure cuts, and Fiscal deficit etc in the recently presented Interim Union Budget for the 2024-25.

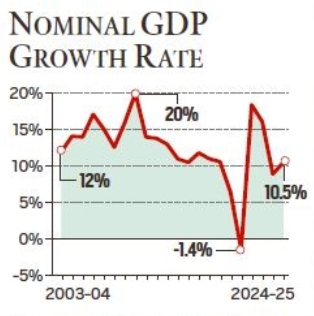

On GDP Growth:

- The nominal Gross Domestic Product (GDP) is the size of the Indian economy in terms of current prices.

- It is the actual observed value.

- The real GDP growthand its rate are derived from the nominal GDP data by removing the effect of inflation.

- For instance, if nominal GDP growth in a particular year is 12% and inflation is 4%, then the real GDP growth will be 8%.

- However, for all budget-related work, it is the nominal GDP that is used.

- It means a decent growth rate in nominal GDP is not good for India’s real growth rate.

- For the coming year, the nominal GDP is likely to grow by just 10.5%.

- If an inflation rate of 4-4.5% it would suggest a GDP growth rate of 6% to 6.5% in 2024-25.

On the reduction in Fiscal Deficit:

- Fiscal deficit essentially shows the amount of money that the government borrows from the market. It does so to bridge the gap between its expenses and income.

- If a government borrows more, it leaves a smaller pool of money for the private sector to borrow from.

- It, in turn, leads to higher interest rates, thus disincentivizing borrowings by the private sector and further dragging down economic activity in the form of lower consumption and production.

- If the government tries to print more money instead of borrowing from the market, that too leads to negative effects such as inflation.

- If fiscal deficits continue to grow unrestrained— repaying the debt and associated annual interest payments tends to become a critical concern.

- It eventually requires governments to tax its citizens, which, again, slows down economic activity.

| The Fiscal Responsibility and Budget Management Act (2003): – It requires the Union government to contain its fiscal deficit to just 3% of the nominal GDP. a. However, barring 2007-08, India has never met this target. – In the current year, the government has set a target of 5.9% and revised estimates show it is likely to be even lower at 5.8%, which is further aim to reduce at 5.1% of GDP for FY25, and at 4.5% of GDP for FY26. |

Capital Expenditure (Capex) Target:

- All government expenditure can be divided into two broad categories:

- Revenue expenditure to meet daily needs such as fuel bills, salaries, etc. and;

- Capital expenditure to make productive assets such as roads, schools, bridges, ports, etc.

- There is a clear advantage for the broader economy when the government ramps up Capital expenditure.

- Every Rs 100 spent on capex leads to a Rs 250 increase in GDP. On the other hand, the revenue expenditure returns less than Rs 100.

- The Capex was Rs 10 lakh crore in the Budget 2023-24 — more than double the Rs 4.39 lakh crore of 2020-21.

- However, Revised Estimates (RE) show that this Capex target was not met in the current year — it stands at Rs 9.5 lakh crore.

Expenditure on Health and Education:

- Historically, in India, budget allocations towards health and education have been lower than required.

- These allocations were in the range between 2.5% to 1.5% of the total government expenditure.

- However, the Revised Estimates show that even those targets have not been met in the current financial year.

- The Budget 2024-25 estimated to be 1.9% of the total expenditure for the Union Ministry of Health, continuing the trend of staying below the 2% mark from 2022-23.

Reduction in Core Schemes:

- The Revised Estimates for the outlays on ‘core of core schemes’ show the reduction in funds that was meant for the most disadvantaged sections of society, such as SCs, STs and minorities.

- For example, the Umbrella Scheme for Development of Scheduled Castes is Rs 6,780 (Revised Estimates) crore against the Budget Estimates of Rs 9,409 crore.

- For Scheduled Tribes, the Revised Estimates is Rs 3,286 crore against a Budget Estimates of Rs 4,295 crore.

- For minorities, the fall has been the sharpest.

Interim Budget

Syllabus: GS3/Indian Economy

Context:

- Recently, the Union Finance Minister presented the interim budget for 2024-25 to show the fiscal position, and growth prospects of the Indian economy.

About the Interim Budget:

- It is a temporary budget that is presented by the government in an election year.

- In an election year, the incumbent Government cannot present a full Budget as there may be a change in the executive after the polls.

- It is also known as a ‘Vote on Account’. There is no constitutional provision for it.

How is the Interim Budget different from Annual Budget?

Timing and Scope:

- An Annual Budget is presented on February 1st of each year, outlining the government’s financial roadmap for the entire fiscal year (April 1 to March 31).

- It is a detailed, comprehensive plan covering all aspects of government finances, including revenue generation, expenditure allocations, and policy announcements.

- It is a detailed, comprehensive plan covering all aspects of government finances, including revenue generation, expenditure allocations, and policy announcements.

- An Interim Budget is presented in an election year to keep essential government operations funded until the newly elected government presents its full budget.

- It focuses primarily on maintaining essential spending on ongoing schemes and critical public services until the new government takes charge.

Policy Announcements:

- Due to its transitory nature, an interim budget avoids major policy pronouncements or significant changes to tax structures.

- These are typically reserved for the full budget presented by the new government.

Parliamentary Scrutiny:

- Both Budgets undergo parliamentary scrutiny, but the intensity differs. The Annual Budget faces rigorous debate and analysis.

- However, the Interim Budget receives less scrutiny due to its limited scope and temporary nature.

Validity:

- While the Interim Budget is presented for a shorter duration (usually 2–4 months), it technically remains valid for the entire year.

- However, once the new government presents its full budget, the Interim Budget effectively becomes obsolete.

Blue Economy 2.0

Syllabus: GS3/Economy

Context

- The Interim Budget presented by the Finance Minister recently stressed on environment-friendly development through the promotion of ‘blue economy’.

More about the News

- The budget proposes to promote climate resilient activities for blue economy 2.0 for restoration and adaptation measures.

- Additionally, the budget outlines plans to set up five integrated aqua parks and enhance the Pradhan Mantri Matsya Sampada Yojana (PMMSY) to increase aquaculture productivity, double exports, and generate employment opportunities.

Blue Economy

- The World Bank says the blue economy is the “sustainable use of ocean resources for economic growth, improved livelihoods, and jobs while preserving the health of the ocean ecosystem.”

- Pillars: Fisheries, aquaculture, maritime transport, renewable energy from the sea, coastal tourism, and marine biotechnology.

- Blue economy 1.0 vs 2.0:

- The concept of Blue Economy 2.0 is still evolving, but India’s “Blue Economy 2.0” focuses on specific areas like coastal restoration, aquaculture development, and climate-resilient activities within the broader framework of sustainable ocean management.

Significance

- Huge coastline: India with a 7,517-kilometre-long coastline, with nine coastal states and 1,382 islands the blue economy is highly significant.

- On major sea lines of trade: There are nearly 199 ports, including 12 major ports that handle approximately 1,400 million tons of cargo each year.

- Large EEZ: India’s Exclusive Economic Zone(EEZ) of over 2 million square kilometers has a bounty of living and non-living resources with significant recoverable resources such as crude oil and natural gas.

- Livelihood: The coastal economy sustains over 4 million fisherfolk and coastal communities.

- Economic and Trade Potential: The Indian Ocean Region is abundant with resources, particularly in the sectors of fisheries, aquaculture, ocean energy, sea-bed mining and minerals, and provides tremendous economic opportunities to develop marine tourism and shipping activities.

- Natural resources: Polymetallic nodules and polymetallic massive sulfides are the two mineral resources of commercial interest to developers in the Indian Ocean.

Challenges

Environmental Challenges:

- Overexploitation of resources: Unsustainable fishing practices, pollution, and habitat destruction threaten marine biodiversity and ecosystem health.

- Climate change: Rising sea levels, ocean acidification, and extreme weather events disrupt coastal communities and marine ecosystems.

- Pollution: Untreated sewage, industrial waste, and plastic pollution contaminate coastal waters, impacting human health and marine life.

Economic Challenges:

- Lack of infrastructure: Inadequate port facilities, cold storage, and transportation networks limit efficient utilization of marine resources.

- Limited investment: Insufficient funding for research, innovation, and development of sustainable technologies hampers growth.

- Skill gap: Lack of skilled professionals in areas like marine engineering, aquaculture, and ocean governance hinders development.

Social Challenges:

- Livelihood dependence: Traditional fishing communities face challenges due to resource depletion and competition from large-scale fishing.

- Coastal erosion and displacement: Rising sea levels and extreme weather events displace coastal communities and disrupt livelihoods.

- Equity and access: Equitable distribution of benefits from the Blue Economy remains a concern, particularly for marginalized communities.

Governance Challenges:

- Policy and regulation: Ineffective regulations and enforcement hinder sustainable practices and combating illegal activities like illegal fishing.

- Institutional coordination: Lack of coordination between different government agencies responsible for managing marine resources creates hurdles.

Measures

- Sustainable practices: Implementing measures like quotas, closed seasons, and marine protected areas to ensure sustainable resource utilization.

- Technological innovation: Investing in R&D for technologies like aquaculture, renewable ocean energy, and pollution control.

- Skilling and capacity building: Training programs to equip coastal communities with relevant skills for future Blue Economy jobs.

- Community engagement: Engaging local communities in decision-making processes and ensuring equitable distribution of benefits.

- Strengthened governance: Robust policies, effective enforcement, and improved coordination between government agencies.

- International collaboration: Engaging in regional and global initiatives to address shared challenges and promote sustainable ocean management.

Government steps

- Draft policy on India’s Blue Economy, 2022: Recommended on National Accounting Framework for Blue Economy and Ocean Governance, Coastal Marine Spatial Planning and Tourism Priority, Marine Fisheries, Aquaculture and among others.

- Integrated Coastal Zone Management (ICZM) Program: Aims to balance economic development with environmental protection and conservation in coastal areas.

- Sagarmala Project: Focuses on port modernization, coastal infrastructure development, and maritime connectivity to improve logistics and trade.

- Deep Ocean Mission: Promotes research and exploration of the deep sea for sustainable utilization of resources and scientific advancement.

- Indian Ocean Rim Association (IORA): Collaborates with regional countries on Blue Economy initiatives like sustainable fisheries management and marine pollution control.

- The Interim Budget 2024-25 document refers to blue economy 2.0 and announced the setting up of five integrated aqua parks.

- Two priorities for the Supreme Audit Institutions 20 (SAI20) deliberations during the G20 meet were blue economy and responsible Artificial Intelligence.

Way Ahead

- With vast maritime interests, the blue economy occupies a vital potential position in India’s economic growth.

- It could well be the next multiplier of GDP and well-being, provided sustainability and socio-economic welfare are kept center-stage.

- Transitioning from 1.0 to 2.0 requires collaborative efforts from governments, businesses, research institutions, and communities to develop and implement sustainable practices.

Expansion of Nano DAP

Syllabus: GS3/Indian Economy

In Context

- The Finance Minister in the interim budget, announced the expansion of the application of Nano DAP on various crops in all agro climatic zones.

About

- After the successful adoption of Nano Urea, application of Nano DAP, on various crops, will be expanded in all agro-climatic zones as per the Finance Minister.

What is DAP?

- Di-ammonium Phosphate (DAP) is a type of fertilizer that contains phosphorus and nitrogen, two essential nutrients for plant growth.

- It has the chemical formula (NH₄)₂HPO₄.

- DAP is commonly used in agriculture to provide a quick and readily available source of nutrients to plants.

- It is the second most commonly used fertilizer in India after urea.

- It is high in phosphorus (P) that stimulates root establishment and development — without which plants cannot grow to their normal size, or will take too long to mature.

- It is thus applied just before, or at the time of sowing.

What is Nano DAP?

- It is a unique liquid fertilizer product that contains nanoparticles of Diammonium Phosphate (DAP).

- It is a source of nitrogen and phosphorus – 2 key primary nutrients essential for the growth of crops.

- The small size of Nano DAP (< 100 nm) and high surface area drive the easy absorption by plant leaves.

- It is a novel nano-formulation which helps in better crop growth and yield, reduced environmental burden and increased farmer profitability.

| Nanotechnology -It is the development and use of techniques to study physical phenomena and develop new devices and material structures in the physical size range of 1-100 nanometres (nm), where 1 nanometre is equal to one billionth of a meter. – At this scale, the properties of materials can be significantly different from those at larger scales. – Nanotechnology impacts all areas of our lives. These include materials and manufacturing, electronics, computers, telecommunication and information technologies, medicine and health, the environment and energy storage, chemical and biological technologies and agriculture. |

Significance

- More Efficient: The tiny particle size makes Nano DAP more efficient than its conventional counterpart, enabling the fertiliser to enter easily inside the seed surface or through stomata and other plant openings which leads to better quality and increase in crop yields.

- Affordable: A 500 ml bottle of Nano DAP is equivalent to a 50-kg bag of conventional DAP, and is priced at half.

- Since the government provides significant subsidies on DAP, the adoption of a more inexpensive fertilizer will likely be a significant relief to the government’s subsidy burden.

- Convenient: 500 ml bottles are easier to transport, store, and use than 50kg bags.

- Reduction in Imports: India currently imports significant quantities of fertiliser to meet domestic demand.

- The adoption of domestically-produced Nano DAP produced in Gujarat will to significantly reduce this import burden.

Conclusion

- This revolutionary step will not only take Indian agriculture forward in foodgrain production but it will also make India self-reliant in fertilizer production.

Digital Detox

Syllabus: GS3/Developments in Science and Technology

Context

- The Karnataka government recently announced it will ensure a responsible gaming environment by pursuing ‘digital detox’ initiatives.

- The government plans to launch the detox initiative in collaboration with All India Game Developers’ Forum (AIGDF).

| Karnataka’s Digital detox initiative – The digital detox programme will focus on the time people spend in gaming and on social media. – Although the initiative looks counter-productive to the industry, the government is expected to spread awareness on the ills of the sector. – The programme will enable meaningful and constructive use of technology while minimising its adverse effects on individuals and society. – As part of the initiative, both online and offline ‘Digital Detox’ centres will be set up across the state. a. The centres will facilitate personalised guidance involving counselling and support to individuals seeking to navigate their relationship with technology. |

Digital detox

- A digital detox is a period of time when one voluntarily abstains from using digital devices such as smartphones, computers, and social media.

- This can be for a short period of time, like a few hours, or for a longer period, like a week or even a month.

- One study found that around 25% smartphone owners between ages 18 and 44 don’t remember the last time their phone wasn’t right next to them.

Benefits

- Assist people to overcome addiction to technology. Research shows that about 61% of people admit they’re addicted to the internet and their digital screens.

- Improved mental health and wellbeing. Disconnecting from technology can help reduce stress and anxiety, and can improve overall mental health and wellbeing.

- Increased productivity and creativity. Taking a break from constant digital stimulation can help improve focus and concentration, leading to increased productivity and creativity.

- Better sleep quality and quantity. Excessive screen time has been linked to poor sleep quality and disrupted sleep patterns. A digital detox can help improve sleep by reducing exposure to blue light and stimulating content.

- Enhanced face-to-face communication skills. Spending less time online can lead to more time for face-to-face interactions, improving communication skills and overall social connectedness.

Challenges associated

- Feeling disconnected from friends and family.

- Missing out on important information.

- Feeling bored or restless.

- Experiencing withdrawal symptoms like feelings of anxiety, boredom, or FOMO (fear of missing out).

Suggestion

- Start small. Begin with a short detox, like a few hours, and gradually increase the duration as you get more comfortable.

- Let friends and family know about your detox so they don’t think you are ignoring them.

- Find healthy activities to fill detox time, such as spending time in nature, reading, exercising, or spending time with loved ones.

- Turn off notifications on devices and put them away in a place where you won’t see them.

- Reward yourself for sticking to detox goals.

Conclusion

- Mental health issues, shrinking attention spans and fraying real-world relationships are outcomes of digital dependence.

- Technology has woven itself firmly into the fabric of everyone’s lives and being glued to screens has become a norm. This is largely because gadgets offer convenience and connection at the fingertips. At the same time, it is exacting a heavy cost.

- A digital detox can be a great way to improve mental and physical health, as well as relationships with others. With a little planning and effort, one can have a successful and rewarding experience.