Is the caste Census a useful exercise?

Source: The Hindu

Syllabus context: GS II Polity and Governance

Caste Census: A Critical Appraisal

Introduction

The demand for a caste census in India has intensified, fueled by aspirations to address caste-based inequities in resource allocation and policy implementation. Proponents see it as a means to achieve social justice, while critics argue it could deepen social divisions, foster regressive politics, and strain administrative machinery. This complex issue warrants a nuanced analysis, encompassing historical context, operational challenges, and socio-political implications, to evaluate its feasibility and impact on governance and nation-building.

Historical Context of Caste Census in India

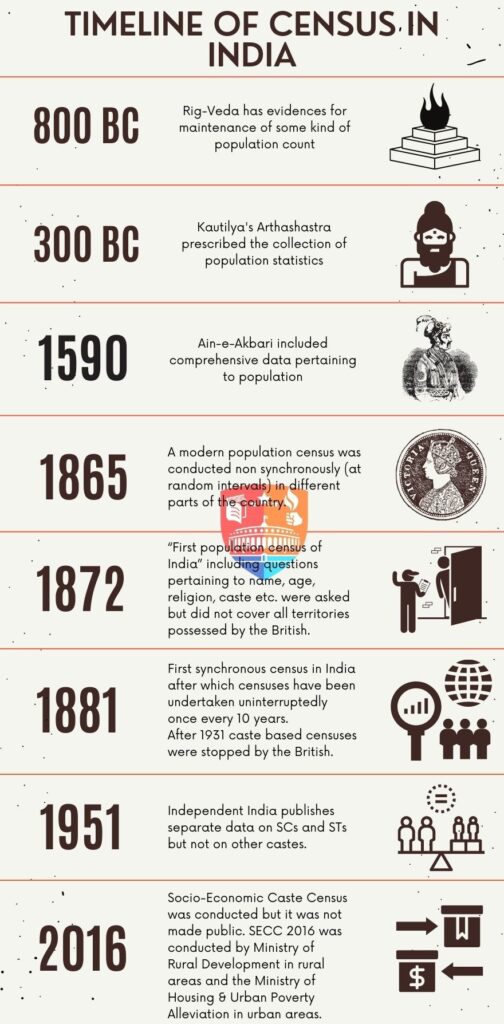

The practice of caste enumeration in India began during British colonial rule and has evolved through various phases:

- 1871-72 Census: The first systematic attempt at caste enumeration faced challenges due to India’s complex caste system. Arbitrary classifications (e.g., “servants and laborers”) led to unreliable data.

- 1931 Census: Identified 4,147 castes but was criticized for inaccuracies as communities reported differing identities across regions.

- Post-Independence: The Socio-Economic and Caste Census (SECC) 2011 recorded an overwhelming 46.7 lakh caste categories and 8.2 crore errors, exposing the inherent difficulties in accurately categorizing caste identities.

These experiences underline the persistent challenges in conducting a reliable caste census, including caste fluidity, misclassification, and subjective reporting by respondents.

Challenges in Conducting a Caste Census

1. Caste Fluidity and Misclassification

- Upward Mobility: Some communities report affiliation with higher castes to gain social prestige.

- Downward Mobility: Others claim lower caste status to access benefits under the reservation system.

- Similar-Sounding Castes: Confusion arises when castes with similar names (e.g., ‘Dhanak,’ ‘Dhanuk,’ ‘Dhanka’) are misclassified.

2. Data Collection Complexity

- Enumerator Bias: Sensitive questions on caste often lead to reliance on assumptions rather than accurate self-reporting.

- Historical Errors: The Bihar caste census of 2022 included anomalies such as classifying “hijra” and “kinnar” as castes, highlighting persistent inconsistencies.

3. Administrative and Logistical Burdens

- Conducting a caste census would require massive resources, from training enumerators to handling data validation. This could divert attention and funding from other pressing developmental priorities.

Proportional Representation: A Conceptual Critique

Current Framework

India’s reservation system allocates quotas based on broad categories such as Scheduled Castes (SC), Scheduled Tribes (ST), and Other Backward Classes (OBC). Proponents of a caste census argue that accurate data would enable proportional representation for all castes.

Practical Limitations

- Skewed Benefits:

- India has over 6,000 castes with significant population disparities. The average caste size is 2.3 lakh, but smaller castes (e.g., those with 10,000 members) risk being underrepresented due to impractical quota calculations.

- Example: In a UPSC recruitment cycle with 1,000 vacancies, it could take 141 years for a caste with 10,000 members to secure one reserved position under proportional representation.

- Exclusion of Smaller Castes:

- More populous castes are likely to dominate the benefits, sidelining smaller, marginalized groups and defeating the principle of inclusivity.

- Administrative Impracticality:

- With over 46.7 lakh caste categories reported in SECC 2011, implementing proportional representation would be an unmanageable task, hindering governance efficiency.

Socio-Political Implications

- Risk of Deepening Divisions:

- A caste census could reinforce caste identities, fueling identity politics and undermining efforts to promote a unified national identity.

- Political parties may exploit caste data for vote-bank politics, further fragmenting society.

- Narrow Focus on Caste:

- Overemphasis on caste-based entitlement risks sidelining broader socio-economic inequalities and issues such as education, healthcare, and employment opportunities.

- Impact on Social Cohesion:

- Caste enumeration might perpetuate perceptions of inequality, intensify inter-caste rivalries, and hinder progress toward a more equitable society.

Way Forward

- Shift Focus to Socio-Economic Parameters:

- Instead of caste-based enumeration, data on economic status, education levels, and healthcare access should guide policy decisions to address inequality comprehensively.

- Strengthen Existing Mechanisms:

- Optimize the existing reservation system to ensure better inclusion of smaller and marginalized castes within the current framework.

- Foster Unity and Social Harmony:

- Encourage policies that promote common citizenship and social cohesion, moving beyond narrow identity-based frameworks.

- Evidence-Based Policy Making:

- Leverage anonymized, aggregated data for targeted interventions without exacerbating caste divisions.

Conclusion

While the demand for a caste census stems from the aspiration for social justice, its implementation could prove counterproductive due to inherent challenges and risks of societal fragmentation. Instead, India should focus on inclusive policies that transcend caste distinctions and address structural inequalities, fostering a society built on equity, unity, and progress. As Mahatma Gandhi aptly noted, “The best way to find yourself is to lose yourself in the service of others.” This ethos must guide India’s quest for social justice and governance reform.

Windfall gains tax on oil production, diesel-petrol export removed: The impact, explained

Source: Indian Express

Syllabus context: GS III Economy

India’s Removal of the Windfall Gains Tax

Introduction

The Government of India recently withdrew the windfall gains tax on domestic crude oil production and fuel exports (diesel, petrol, and aviation turbine fuel—ATF). Introduced on July 1, 2022, during the global energy turmoil triggered by Russia’s invasion of Ukraine, the tax aimed to address surging international crude oil prices and safeguard domestic fuel availability. The decision to scrap the levy reflects changing global and domestic economic conditions, making it a significant policy shift.

Understanding Windfall Gains Tax

Definition

- A windfall tax is levied on unexpected or unearned profits arising from external events, such as geopolitical crises.

- As defined by the U.S. Congressional Research Service, it is an unanticipated gain achieved without additional effort or expense by the company.

- Governments impose these one-off retrospective taxes above regular tax rates to redistribute extraordinary profits.

Purpose of Windfall Taxes

- Redistribution: Redirects windfall gains from producers to consumers.

- Social Welfare: Funds welfare schemes or other government programs.

- Revenue Generation: Provides supplementary income for governments.

- Trade Deficit Management: Addresses widening trade deficits by utilizing additional revenue.

Criticism of Windfall Taxes

- Market Uncertainty: Retrospective imposition of taxes creates unpredictability, discouraging future investments.

- Populism: Often seen as politically opportunistic, with design flaws stemming from hasty implementation.

- Risk-Reward Imbalance: Companies argue that high profits compensate for risks taken in the sector.

- Targeted Taxation Issues: Determining whether all companies or only large profit-making entities should be taxed remains contentious.

Withdrawal of Windfall Gains Tax

Background

- Introduction: The windfall tax was introduced in response to global disruptions caused by the Russia-Ukraine war, which sent crude oil prices soaring above $100 per barrel.

- Objective: Address fears of fuel shortages in the domestic market and regulate profits from surging prices.

Recent Developments

- On December 2, 2024, the government officially removed the tax due to improved global market stability and diminishing risks of supply shocks.

Reasons for Withdrawal

Global Stabilization

- Crude oil prices fell significantly, from over $100 to below $75 per barrel.

- Supply chains normalized after initial disruptions.

Domestic Market Dynamics

- Fuel availability in the domestic market remained robust.

- The declining revenue from the windfall tax reduced its fiscal utility.

Revenue Decline

- FY23: ₹25,000 crore.

- FY24: ₹13,000 crore.

- FY25 (till now): ₹6,000 crore.

Impact of Scrapping the Windfall Tax

Oil Producers and Exporters

- No significant financial burden remains on major stakeholders such as ONGC, OIL, Reliance Industries, and Nayara Energy.

- Eliminates unpredictability in taxation, encouraging long-term investments.

Market Confidence

- Signals stability in global oil markets and reduced risks of price surges.

- Highlights India’s readiness to adjust fiscal policies based on evolving economic scenarios.

Wider Economic Implications

- Encourages foreign and domestic investment in the oil sector by reducing policy unpredictability.

- Frees fiscal space for the government to focus on other critical areas of economic development.

Conclusion

The removal of the windfall gains tax marks a pivotal policy decision, reflecting stabilized global oil markets and robust domestic conditions. While it served a critical purpose during a period of energy crisis, its withdrawal ensures a predictable business environment and signals confidence in economic stability. The government’s decision highlights its commitment to balancing fiscal responsibility with long-term growth imperatives, reinforcing India’s position as a resilient and adaptable economy.

India’s strategic focus on West Africa

Source: The Hindu

Syllabus context: GS II International Relations

Context

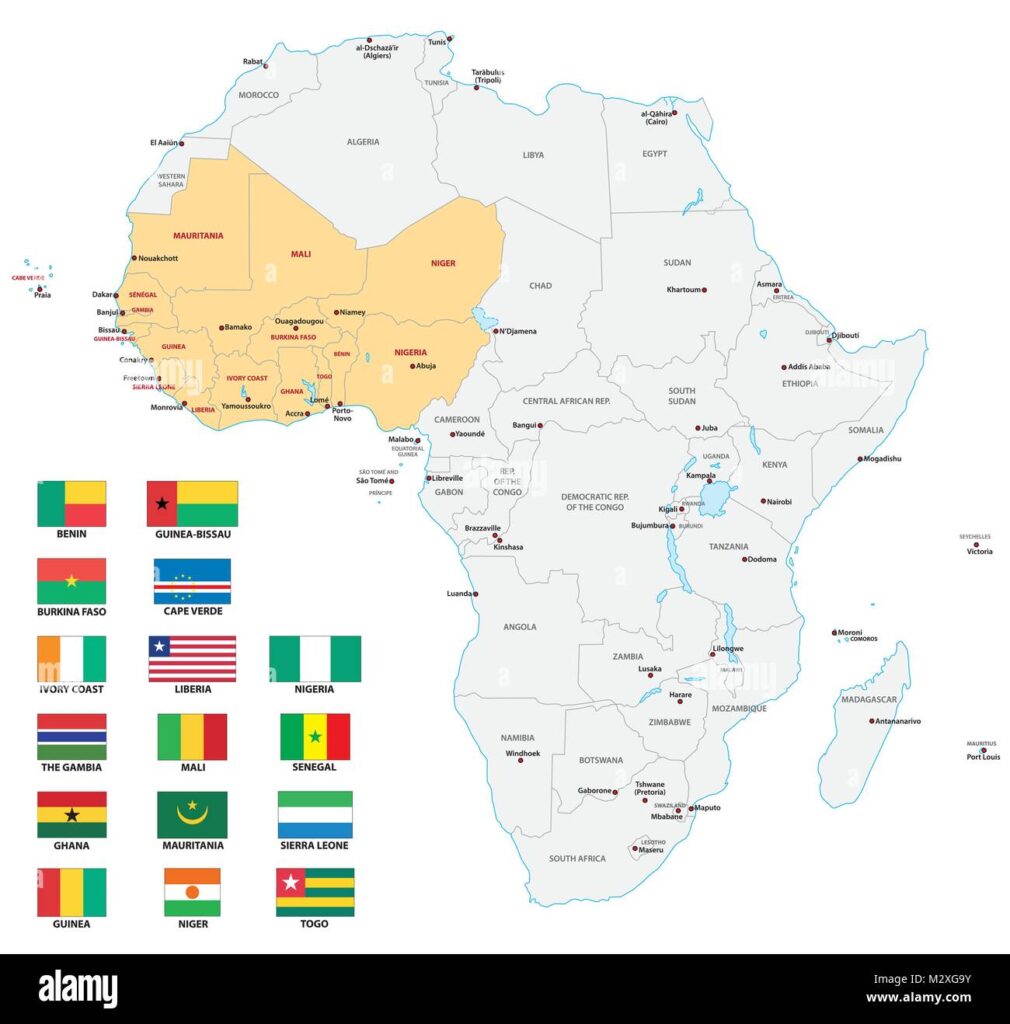

India’s growing strategic engagement with West Africa, particularly with Nigeria, underscores the nation’s broader vision for enhancing ties with the African continent. Prime Minister Narendra Modi’s recent visit to Nigeria highlights the significance of this bilateral relationship, marking the first visit by an Indian Prime Minister to the country in 17 years. This visit, coupled with Modi’s earlier travels to 10 African countries, exemplifies India’s increasing diplomatic and economic interest in the African region. Given Nigeria’s position as the largest economy and democracy in Africa, as well as its role as a regional power, strengthening ties with Nigeria has implications beyond bilateral cooperation, influencing broader geopolitical dynamics in the Global South.

Strategic Importance of India-Nigeria Relations:

Nigeria, with its vast natural resources and large population, is pivotal for India’s strategic interests in Africa. It serves as a key partner in a range of sectors, from defence and security to trade, technology, and education. During Modi’s visit, the two nations discussed expanding cooperation on multiple fronts, including counterterrorism operations, where India’s expertise in security matters—especially in dealing with Islamist extremist groups like Boko Haram—could be of significant value. The potential for enhancing defence trade, including arms sales and joint security efforts, has positioned India as an emerging defence supplier to Africa, with similar relationships developing with other African nations like Egypt and Algeria.

India’s support for Nigeria is also evident in its long-standing commitment to developmental assistance. The $100 million concessional loan provided by India for various projects in Nigeria underscores India’s approach to foreign aid—focusing on capacity-building and skill development rather than solely on infrastructure investment. This distinctive ‘India Way’ in foreign relations is rooted in South-South cooperation, emphasizing mutual benefits rather than imbalanced dependencies.

Nigeria’s Economic and Strategic Relationship with China:

While India remains a significant partner to Nigeria, China has strengthened its presence in the country, particularly in infrastructure development. China’s role in funding large-scale projects, such as the Lekki Deep Sea Port and various transportation networks, has transformed Nigeria’s economic landscape. With investments exceeding $47 billion in Nigerian infrastructure, China’s influence continues to grow, especially in sectors like technology, mining, and telecommunications. Huawei’s involvement in building mobile phone infrastructure and cybersecurity initiatives further highlights China’s deep economic penetration into Nigeria. These activities align with China’s broader Belt and Road Initiative, aimed at boosting connectivity and trade across the Global South.

Yet, despite the growing Chinese footprint, India’s position as a key economic and strategic partner to Nigeria remains steadfast. Trade between India and Nigeria, although experiencing a decline in recent years, still represents a significant economic tie. India’s expertise in sectors like pharmaceuticals, energy, and information technology continues to resonate with Nigeria’s developmental needs. Moreover, India’s approach of prioritizing skill-building and sustainable partnerships contrasts with China’s more infrastructure-driven model, offering a complementary alternative for Nigeria.

Challenges and Opportunities:

The India-Nigeria partnership is not without its challenges. The decline in trade from $14.95 billion in 2021-22 to $7.89 billion in 2023-24, partly due to India’s increasing oil imports from Russia, reflects the changing dynamics of global trade. However, India’s long-term strategic focus on diversifying trade and investment in Africa suggests that this decline can be mitigated by focusing on areas beyond oil, such as technology, healthcare, and education.

Furthermore, while Nigeria’s growing economic ties with China may pose a competitive challenge, India’s diplomatic engagement, especially its soft power approach through cultural and educational exchanges, can help foster stronger people-to-people connections. India’s leadership role in multilateral forums such as the G-20 and its alignment with the African Union on global issues presents an opportunity to further deepen Nigeria-India cooperation in international diplomacy.

Conclusion:

India’s strategic focus on Nigeria and West Africa is part of a broader vision to position India as a key player in the Global South. Through collaborative efforts in defence, technology, and development, India is not just strengthening its bilateral ties with Nigeria but also contributing to the larger goals of South-South cooperation. However, the challenge lies in translating the goodwill generated by high-level visits into tangible, long-term outcomes. As India seeks to bolster its global stature, its relationship with Nigeria will be a crucial part of its engagement with Africa, shaping the continent’s future while promoting India’s interests on the world stage.

The growing importance of this partnership is encapsulated in Modi’s visit and the warm reception he received from Nigerian leadership. This momentum, if sustained, has the potential to redefine India’s strategic presence in Africa, reinforcing India’s position as a development partner that offers more than just financial or infrastructural support but also a model for mutual growth and shared prosperity.

A cut in time

Source: The Hindu

Syllabus context: GS II Environment and Ecology

Context

The issue of plastic pollution has emerged as a global environmental challenge, demanding coordinated international action. The United Nations Environment Programme (UNEP) spearheaded the Global Plastics Treaty, a landmark resolution passed in 2022, which sought to phase out plastic pollution, with particular focus on its impact on marine environments. While this resolution was hailed as a historic step, aimed at curbing plastic pollution, its implementation has faced significant hurdles, highlighting the complexities involved in balancing environmental concerns with economic interests.

Divisive Global Response:

The negotiation process has proven to be contentious. At the heart of the debate lies the tension between environmental priorities and economic realities. While nearly 170 countries participated in the discussions, there was a clear divide between developed and developing nations. A significant bloc of countries, particularly led by the European Union and supported by Pacific island nations, argued that the vast indestructibility of plastic and its pervasive presence in ecosystems required a radical shift. These nations contended that the plastic pollution crisis could no longer be managed merely by improving recycling systems or waste management but necessitated a systematic reduction in plastic production, particularly of virgin polymers.

On the other hand, many large developing countries, including those reliant on petrochemical industries, opposed such a drastic approach. These countries, including India, expressed concerns about the economic implications of limiting plastic production, especially given that plastic is integral to a range of industries, from packaging to healthcare. They viewed proposals to cut plastic production as veiled trade barriers that would hinder economic growth, especially in economies where petrochemical refining and the plastics industry are key drivers. As a result, the talks have stalled, and the future of the treaty remains uncertain, with continued negotiations expected to seek a more balanced and equitable solution.

India’s Position:

India, a major producer and consumer of plastic, faces a unique dilemma. While it has aligned itself with the developing nations opposing production cuts, it must also confront the realities of its plastic waste management. India’s plastic recycling capacity is limited, recycling only about a third of the plastic it generates annually. The rapidly increasing plastic consumption, driven by its burgeoning population and expanding economy, exacerbates the waste management crisis. This challenge is particularly acute in urban areas, where waste segregation and recycling infrastructure are often inadequate.

India’s environmental policy must recognize that plastic pollution has far-reaching consequences for public health, biodiversity, and the economy. The toxic effects of plastic in ecosystems are not confined to marine life; terrestrial ecosystems, wildlife, and human populations are equally vulnerable to the pervasiveness of microplastics. Studies have shown that plastic particles have entered the food chain, affecting human health through contaminated water and food. In this context, India’s environmental strategy must balance its economic interests with the urgency of addressing plastic’s detrimental effects on public health and the environment.

The Economic Costs and Health Implications:

Plastic, undeniably, plays a significant role in modern economic systems, particularly in sectors such as packaging, construction, and healthcare. However, its widespread use has led to a complex web of economic and environmental consequences. The economic costs of plastic pollution—ranging from clean-up operations to the loss of biodiversity and the deterioration of marine resources—are considerable and continue to rise. Moreover, the burden on public health systems, due to the contamination of food and water sources by plastic waste, adds another layer of concern.

While the economic indispensability of plastic cannot be denied, its adverse health impacts, especially in a country like India, which faces a public health crisis in terms of air and water pollution, cannot be ignored. India’s reliance on plastic, particularly in packaging, poses a challenge to public health. There is mounting evidence of plastics leaching harmful chemicals into food products and drinking water, potentially leading to long-term health risks, including endocrine disruption and cancer. Therefore, India’s strategy on plastic waste management must include a rigorous evaluation of its health impacts and an exploration of alternatives that can mitigate both health and environmental hazards.

A Balanced Approach:

India’s stance on opposing production cuts in the global treaty needs to be reconsidered in light of the broader ecological and health costs associated with plastic pollution. A phased approach to reducing plastic production, along with the promotion of more sustainable materials and improved waste management systems, would allow for a more balanced transition. India could adopt measures such as incentivizing the use of biodegradable plastics, improving waste segregation at the source, and expanding recycling technologies.

Furthermore, fostering innovation in alternative materials, such as plant-based plastics and packaging, would align India with global trends towards sustainability while protecting economic interests. Investment in circular economy models, which emphasize the reuse and recycling of materials, could create new economic opportunities while reducing the environmental footprint of plastic waste.

Conclusion:

The global effort to combat plastic pollution requires pragmatic, context-specific solutions that take into account both environmental sustainability and economic realities. While India’s economic dependency on plastic production cannot be overlooked, a forward-looking, strategic approach to addressing plastic pollution is essential. India’s commitment to addressing plastic pollution should be proactive, with a focus on both global cooperation and domestic solutions that minimize health risks, protect the environment, and foster sustainable economic growth. As the global community continues its negotiations, it is essential that India takes a leadership role in finding creative solutions that balance economic growth with environmental stewardship, ensuring that it does not find itself on the wrong side of history in the fight against plastic pollution.