Finance Minister and TN on fuel taxes and GST for fuel

Context:

Indian Finance Minister took on the Tamil Nadu government or reducing State levies on petroleum products by ₹3 a litre, after an earlier hike of ₹7 a litre (by the previous AIADMK regime), and accused it of being party to the UPA’s “trickery” of lowering fuel prices by issuing oil bonds.

Previously, the Finance Minister of India had said that the Centre is ready to consider bringing fuel under the Goods and Services Tax regime if the States bring up the issue at the GST Council.

Relevance:

GS-III: Indian Economy (Economic Development of India, Macroeconomics- Taxation)

Dimensions of the Article:

- Current Pricing of Petrol and Diesel

- How much tax do we pay on petrol and diesel?

- Bringing Fuel under GST

- Impact of Bringing Fuel under GST

Current Pricing of Petrol and Diesel

- As per the latest (as of March 2021) price-build of petrol and diesel: State taxes had a smaller contribution to the retail price than central taxes.

- While the state Value Added Tax (VAT) was just over 10 and 20 rupees, on diesel and petrol respectively, the union excise duties for both petrol and diesel exceeded 30 Rs.

- These headline numbers suggest that the centre is a bigger beneficiary of tax incomes from the sale of petrol and diesel.

- This is because FFC’s earmarked share of states in centre’s revenues applies to what is called the divisible pool of taxes, which excludes cess and other forms of special taxes. Overtime, the weight of cess and other such non-sharable taxes has been increasing in the centre’s gross tax revenue. This, in practice, has meant that the share of states in gross total revenue of the centre has never reached 41% and in fact gone down overtime.

How much tax we pay on petrol and diesel?

- The Union and state levies put together account for roughly 55 per cent and 52 per cent of the retail price of petrol and diesel respectively.

- These work out to around 135 per cent and 116 per cent of the base prices of the two products respectively.

- The central levy on petrol and diesel works out to around 36 per cent of the retail price while the state component is around 20 per cent (diesel) to 28 per cent (petrol).

- Of the total central levies on petrol and diesel, Rs 1.40 per litre and Rs 1.80 per litre is the basic excise duty for the two fuels, and Rs 11 per litre and Rs 18 per litre is the special additional excise duty.

- Both these components form part of the divisible pool of taxes i.e. 42 per cent of which (approximately Rs 52,000 crore) goes to the states.

- The remaining portion of Rs 18 per litre in both cases is the Road and Infrastructure Cess and Rs 2.50 per litre and Rs 4 per litre is the Agriculture Infrastructure and Development Cess which are retained by the Centre.

Bringing Fuel under GST

- Economists have said that bringing petrol and diesel under the goods and services tax is an unfinished agenda of the GST framework and getting the prices under the new indirect taxes framework can help.

- Centre and states are loathing to bring crude oil products under the GST regime as sales tax/VAT (value added tax) on petroleum products is a major source of own tax revenue for them.

- Thus, there is lack of political will to bring crude under the ambit of GST.

- At present, states choose to levy a combination of ad valorem tax, cess, extra VAT/surcharge based on their needs and these taxes are imposed after taking into account the crude price, the transportation charge, the dealer commission and the flat excise duty imposed by the Centre.

Impact of bringing Fuel under GST

- A growth in the consumption – diesel going up 15 per cent and petrol by 10 per cent – has been used to assess the Rs 1 lakh crore fiscal impact of getting petroleum prices under GST.

- States, which have the highest share of tax revenues at present, will be the biggest losers if the system shifts to GST.

- However, such a move will help consumers pay up to Rs 30 less per liter of fuel. This is because he highest slab under the existing GST rates is 28%. Even if petrol and diesel were to be taxed at the highest rate, the post-tax price will be much lower than what it is currently.

How much will be the loss of revenue?

- A 28 per cent levy of GST on the base price would fetch around Rs 5.40 per litre on petrol and around Rs 5.45 on diesel to the central and each of the state governments.

- Contrast the above with the current yield of Rs 32.90 per litre on petrol and Rs 31.80 per litre on diesel to the Centre alone and an average of around Rs 20 per litre and Rs 15 per litre on petrol and diesel, respectively, to each of the states.

- This, however, would bring down the prices of petrol and diesel to around Rs 55 per litre.

- This would translate into a revenue loss of around Rs 3 lakh crore on account of petrol and around Rs 1.1 lakh crore on account of diesel to the Centre and the states, at current volumes.

Loss of autonomy

- Once petrol and diesel are subsumed within the GST, both the Centre and states will have to give away the current autonomy they enjoy with these taxes which serve twin purposes of counter-cyclical interventions in the realm of both politics and economy.

- For example, both the Centre and the states increased taxes on petrol and diesel to compensate for revenue loss during the lockdown.

- The central taxes on petrol and diesel are a fixed amount per litre rather than a fraction of the base price, which is how GST is levied currently.

- Also, the current regime allows individual state governments to change their taxes – poll bound Assam has reduced taxes on petrol-diesel – a leeway which will not exist once they are subsumed within GST, as taxes will have to be uniform across the country.

Parliamentary Standing Committee on Decentralized Procurement Scheme (DCP)

Context:

The Parliamentary Standing Committee on Food, Consumer Affairs and Public Distribution (Standing Committee) flagged the only 23 states have implemented the Decentralized Procurement Scheme (DCP) so far — 15 to procure rice and eight to procure wheat — despite the scheme being in place for 23 years.

Relevance:

GS-III: Agriculture (Public Distribution System PDS, Buffer Stocks & Food Security, Government Policies & Interventions)

Dimensions of the Article:

- Decentralized Procurement System (DCP)

- States implementing DCP

- Public Distribution System (PDS)

- How PDS System Functions?

Decentralized Procurement System (DCP)

- The scheme of Decentralized Procurement of foodgrains was introduced by the Government in 1997-98 with a view to enhancing the efficiency of procurement and PDS and encouraging local procurement to the maximum extent thereby extending the benefits of MSP to local farmers as well as to save on transit costs.

- This also enables procurement of foodgrains more suited to the local taste.Under this scheme, the State Government itself undertakes direct purchase of paddy/rice and wheat and also stores and distributes these foodgrains under NFSA and other welfare schemes.

- The Central Government undertakes to meet the entire expenditure incurred by the State Governments on the procurement operations as per the approved costing.

- The Central Government also monitors the quality of foodgrains procured under the scheme and reviews the arrangements made to ensure that the procurement operations are carried smoothly.

States which are under DCP system (as of August 2021)

| So. No. | State/UT | DCP adopted for |

| 1 | A&N Islands | Rice |

| 2 | Bihar | Rice/Wheat |

| 3 | Chhattisgarh | Rice/Wheat |

| 4 | Gujarat | Rice/Wheat |

| 5 | Karnataka | Rice |

| 6 | Kerala | Rice |

| 7 | Madhya Pradesh | Rice/Wheat |

| 8 | Odisha | Rice |

| 9 | Tamil Nadu | Rice |

| 10 | Uttarakhand | Rice/Wheat |

| 11 | West Bengal | Rice/Wheat |

| 12 | Punjab | Wheat |

| 13 | Rajasthan ( in 9 District)* | Wheat |

| 14 | Andhra Pradesh | Rice |

| 15 | Telangana | Rice |

| 16 | Maharashtra | Rice |

| 17 | Jharkhand (6 District) | Rice |

Public distribution system (PDS)

- The Public distribution system (PDS) is an Indian food Security System established under the Ministry of Consumer Affairs, Food, and Public Distribution.

- PDS evolved as a system of management of scarcity through distribution of food grains at affordable prices.

- PDS is operated under the joint responsibility of the Central and the State Governments.

- The Central Government, through Food Corporation of India (FCI), has assumed the responsibility for procurement, storage, transportation and bulk allocation of food grains to the State Governments.

- The operational responsibilities including allocation within the State, identification of eligible families, issue of Ration Cards and supervision of the functioning of Fair Price Shops (FPSs) etc., rest with the State Governments.

- Under the PDS, presently the commodities namely wheat, rice, sugar and kerosene are being allocated to the States/UTs for distribution. Some States/UTs also distribute additional items of mass consumption through the PDS outlets such as pulses, edible oils, iodized salt, spices, etc.

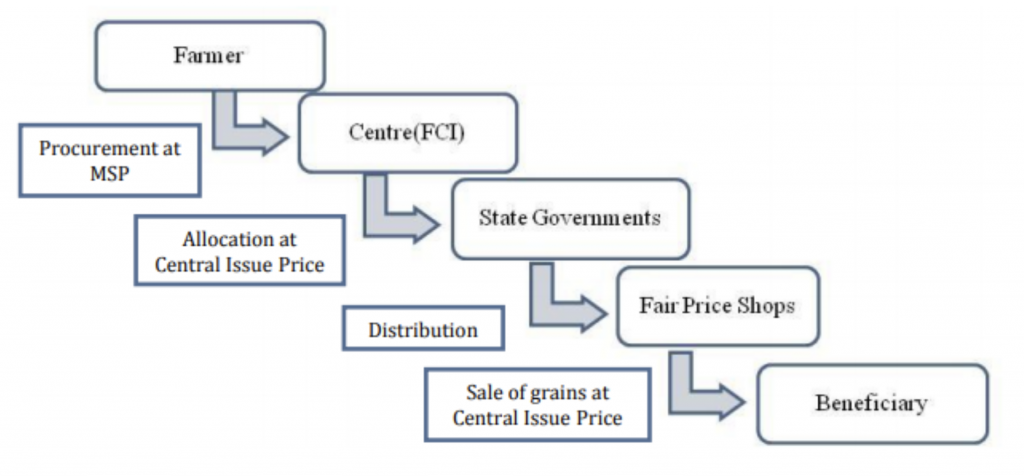

How PDS system functions?

- The Central and State Governments share responsibilities in order to provide food grains to the identified beneficiaries.

- The centre procures food grains from farmers at a minimum support price (MSP) and sells it to states at central issue prices. It is responsible for transporting the grains to godowns in each state.

- States bear the responsibility of transporting food grains from these godowns to each fair price shop (ration shop), where the beneficiary buys the food grains at the lower central issue price. Many states further subsidise the price of food grains before selling it to beneficiaries.

Role of Aadhar In PDS:

- Integrating Aadhar with TPDS will help in better identification of beneficiaries and address the problem of inclusion and exclusion errors. According to a study by the Unique Identification Authority of India, using Aadhaar with TPDS would help eliminate duplicate and ghost (fake) beneficiaries, and make identification of beneficiaries more accurate.

Technology-based reforms of TPDS implemented by states:

- Wadhwa Committee, appointed by the Supreme court, found that certain states had implemented computerisation and other technology-based reforms to TPDS. Technology-based reforms helped plug leakages of food grains during TPDS.

- Tamil Nadu implements a universal PDS, such that every household is entitled to subsidised food grains.

- States such as Chhattisgarh and Madhya Pradesh have implemented IT measures to streamline TPDS, through the digitisation of ration cards, the use of GPS tracking of delivery, and the use of SMS based monitoring by citizens.

Impact of delay in Census 2021

Context:

Recently, the Ministry of Home Affairs has said in the Lok Sabha that owing to the outbreak of Covid-19 pandemic, Census 2021 and other Census-related field activities have been postponed until further orders.

It was also said that the Census 2021 will be carried out using a mobile phone app. It will be used to collect data by school teachers who will double up as enumerators during the Census exercise.

Relevance:

GS-II Governance (Population and Associated Issues, Government Policies & Interventions)

Dimensions of the Article:

- About the Census

- What is different about the 2021 census?

- How will the delay affect PDS and other schemes?

About the Census (with prelims bits)

- The census provides information on size, distribution and socio-economic, demographic and other characteristics of the country’s population.

- The first synchronous census in India was held in 1881, and since then, censuses have been undertaken uninterruptedly once every ten years.

- India’s last census was carried out in 2011 when the country’s population stood at 121 crores.

- The Census 2021 will be conducted in 18 languages out of the 22 scheduled languages (under 8th schedule) and English, and the option of “Other” under the gender category will be changed to “Third Gender”.

- For the first time data is proposed to be collected through a mobile app by enumerators and they will receive an additional payment as an incentive.

- The last caste-based census was conducted by the British in 1931.

- Arthashastra by ‘Kautilya’ written in the 3rd Century BC prescribed the collection of population statistics as a measure of state policy for taxation.

- In India, a census is conducted every decade and Census 2021 will be the 16th national census of the country.

What is different about the 2021 census?

- It is for the first time the data is collected digitally via mobile applications (installed on enumerator’s phone) with a provision of working in offline mode.

- The Census Monitoring & Management Portal will act as a single source for all officers/officials involved in Census activities to provide multi-language support.

- It is for the first time that information of households headed by a person from the Transgender Community and members living in the family will be collected. Earlier there was a column for male and female only.

- The latest Census (as per the existing plan) will not collect caste data. While the Socio-Economic Caste Census (SECC) was conducted alongside Census 2011, the outcome of the caste Census is yet to be made public.

How will the delay affect PDS and other schemes?

- The National Food Security Act, 2013, says that 75% of the rural population and 50% of the rural population — adding up to 67% of the country’s total population — are entitled to receive subsidised food grains from the government under the targeted public distribution system (PDS).

- Under the 2011 Census, India’s population was about 121 crore, hence PDS covered approximately 80 crore people. However, some economists have pointed out that population growth over the last decade means that if the 67% ratio is applied to 2020’s projected population of 137 crore, PDS coverage should have increased to around 92 crore people.

- Although Census data may have been initially used to estimate the coverage of the National Social Assistance Programme, which provides basic pension to 3.09 crore widows, disabled and elderly people below the poverty line, the Centre had announced its intent to shift to the Socio-Economic Caste Census data of 2011 instead to determine beneficiaries of the scheme.

- Most other Central schemes, from health insurance to housing entitlements, use SECC data to estimate their beneficiary coverage, although it is also outdated by almost a decade.

- The Census measures migration by counting those whose current residence is different from their place of birth, which would give the overall number of migrants, as well as by asking for the last place of residence and the reasons for moving, which allows an understanding of movements and trends over the last decade when compared with previous Census data. Hence, the delay will mean that we will continue to have no answers on how many migrants are likely to be stranded in each city or State and in need of food relief or transport support.

Minorities must be treated as ‘weaker sections’: NCM

Context:

The Delhi High Court extended the deadline given to the Centre to nominate persons to all the vacant positions in the National Commission for Minorities by two months (till September 2021).

The National Commission for Minorities (NCM) is now down to just one member. There is only one vice-chairperson, who is currently functioning in the Commission.

The National Commission for Minorities (NCM) has told the Supreme Court that minorities have to be treated as the “weaker sections” in India, justifying the Union government’s various schemes for religious minorities.

Relevance:

GS-II: Polity and Governance (Constitutional Provisions, Statutory Bodies, Government Policies and Interventions), GS-II: Social Justice and Governance

Dimensions of the Article:

- What the National Commission for Minorities said regarding ‘weaker sections’?

- About National Commission for Minorities (NCM)

- Formation of the National Commission for Minorities (NCM)

- Functions of the NCM

- Composition of the NCM

- Constitutional Provisions

What the National Commission for Minorities said regarding ‘weaker sections’?

- The National Commission for Minorities (NCM) has told the Supreme Court that minorities have to be treated as the “weaker sections” in India, where Hindus are “predominant,” as the body justified the Union government’s various schemes for religious minorities.

- NCM maintained that “numerically smaller or weaker classes are bound to be suppressed and overpowered by the dominant majority groups” if special provisions and schemes were not framed by the government.

- It added that the pertinent constitutional provisions on framing special schemes could not be limited to caste-based identities and must include in its fold religious minorities to ensure practical and empirical equality of all groups and classes in the society.

- The Centre and the NCM have notified Muslims, Christians, Sikhs, Buddhists, Jains and Parsis as minority communities in India. Contending that only Hindus, Sikhs and Buddhists could get benefits as scheduled castes, the commission argued that if these special provisions were valid despite being religion-specific, special provisions for religious minorities were also justified in the same manner.

- The commission emphasised that the interpretation of the Constitution coupled with judicial trends would demonstrate that religious and linguistic minorities “have to be” treated as specific identities entitled to special protection by the state.

About National Commission for Minorities (NCM)

- The Union Government set up the National Commission for Minorities (NCM) under the National Commission for Minorities Act, 1992. Hence, the NCM is a Statutory Body.

- Six religious communities, viz; Muslims, Christians, Sikhs, Buddhists, Zoroastrians (Parsis) and Jains have been notified in Gazette of India as minority communities by the Union Government all over India.

- The term “minority” is not defined in the Indian Constitution. However, the Constitution recognises religious and linguistic minorities – The NCM Act defines a minority as “a community notified as such by the Central government.”

- The NCM adheres to the United Nations Declaration of 18 December 1992 which states that “States shall protect the existence of the National or Ethnic, Cultural, Religious and Linguistic identity of minorities within their respective territories and encourage conditions for the promotion of that identity.”

Formation of the National Commission for Minorities (NCM)

- In 1978, setting up of the Minorities Commission (MC) was envisaged in the Ministry of Home Affairs Resolution.

- In 1984, the MC was detached from the Ministry of Home Affairs and placed under the newly created Ministry of Welfare, which excluded linguistic minorities from the Commission’s jurisdiction in 1988.

- In 1992, with the enactment of the NCM Act, 1992, the MC became a statutory body and was renamed as the NCM.

- In 1993, the first Statutory National Commission was set up and five religious communities viz the Muslims, Christians, Sikhs, Buddhists and Zoroastrians (Parsis) were notified as minority communities.

- In 2014, Jains were also notified as a minority community.

Functions of the NCM

- Evaluate the progress of the development of Minorities under the Union and States.

- Monitor the working of the safeguards provided in the Constitution and in laws enacted by Parliament and the State Legislatures.

- Make recommendations for the effective implementation of safeguards for the protection of the interests of Minorities by the Central Government or the State Governments.

- Look into specific complaints regarding deprivation of rights and safeguards of the Minorities and take up such matters with the appropriate authorities.

- Cause studies to be undertaken into problems arising out of any discrimination against Minorities and recommend measures for their removal.

- Conduct studies, research and analysis on the issues relating to socio-economic and educational development of Minorities.

- Suggest appropriate measures in respect of any Minority to be undertaken by the Central Government or the State Governments.

- Make periodical or special reports to the Central Government on any matter pertaining to Minorities and in particular the difficulties confronted by them.

- Any other matter which may be referred to it by the Central Government.

Composition of the NCM

- The NCM is mandated to have seven members, including a chairperson and vice-chairperson, with a member each from the Muslim, Christian, Sikh, Buddhist, Parsi and Jain communities.

- Total of 7 persons to be nominated by the Central Government should be from amongst persons of eminence, ability and integrity. The Ministry for Minority Affairs recommends the names to the Prime Minister’s Office.

- Each Member holds office for a period of three years from the date of assumption of office.

Constitutional Provisions

- Article 15 and 16: Prohibition of discrimination against citizens on grounds of religion, race, caste, sex or place of birth. Citizens’ right to ‘equality of opportunity’ in matters relating to employment or appointment to any office under the State, and prohibition in this regard of any discrimination on grounds of religion, race, caste, sex or place of birth.

- Article 25 (1), 26 and 28: People’s freedom of conscience and right to freely profess, practise and propagate religion. Right of every religious denomination or any section to establish and maintain institutions for religious and charitable purposes, manage its own religious affairs, and own and acquire property and administer it. People’s freedom as to attendance at religious instruction or religious worship in educational institutions wholly maintained, recognized, or aided by the State.

- Article 29: It provides that any section of the citizens residing in any part of India having a distinct language, script or culture of its own, shall have the right to conserve the same. It grants protection to both religious minorities as well as linguistic minorities. However, the Supreme Court held that the scope of this article is not necessarily restricted to minorities only, as use of the word ‘section of citizens’ in the Article includes minorities as well as the majority.

- Article 30: All minorities shall have the right to establish and administer educational institutions of their choice. The protection under Article 30 is confined only to minorities (religious or linguistic) and does not extend to any section of citizens (as under Article 29).

- Article 350-B: The 7th Constitutional (Amendment) Act 1956 inserted this article which provides for a Special Officer for Linguistic Minorities appointed by the President of India. It would be the duty of the Special Officer to investigate all matters relating to the safeguards provided for linguistic minorities under the Constitution.